Vibin’ is a financial platform specifically designed to create a real and valuable connection with Gen Z.

The Proposal

Vibin’ is an application designed and developed to transform the current relationship between traditional banks and Generation Z.

Our team has worked hard to design a solution focused on the needs and concerns of this generation as they enter the world of banking, in order to make Santander Bank relevant to a generation whose economic power is the fastest growing in the world.

The Challenge

How might we make ourselves relevant to the unbanked and underbanked population (focusing on the younger generations)?

Key Objective

Renew front-end communication and expand Banco Santander’s ecosystem to be the first choice for Generation Z as they start their financial lives.

Solution

From research and ideation to UI and implementation, we designed Vibin’, the new bespoke front end for GenZ, powered by Santander.

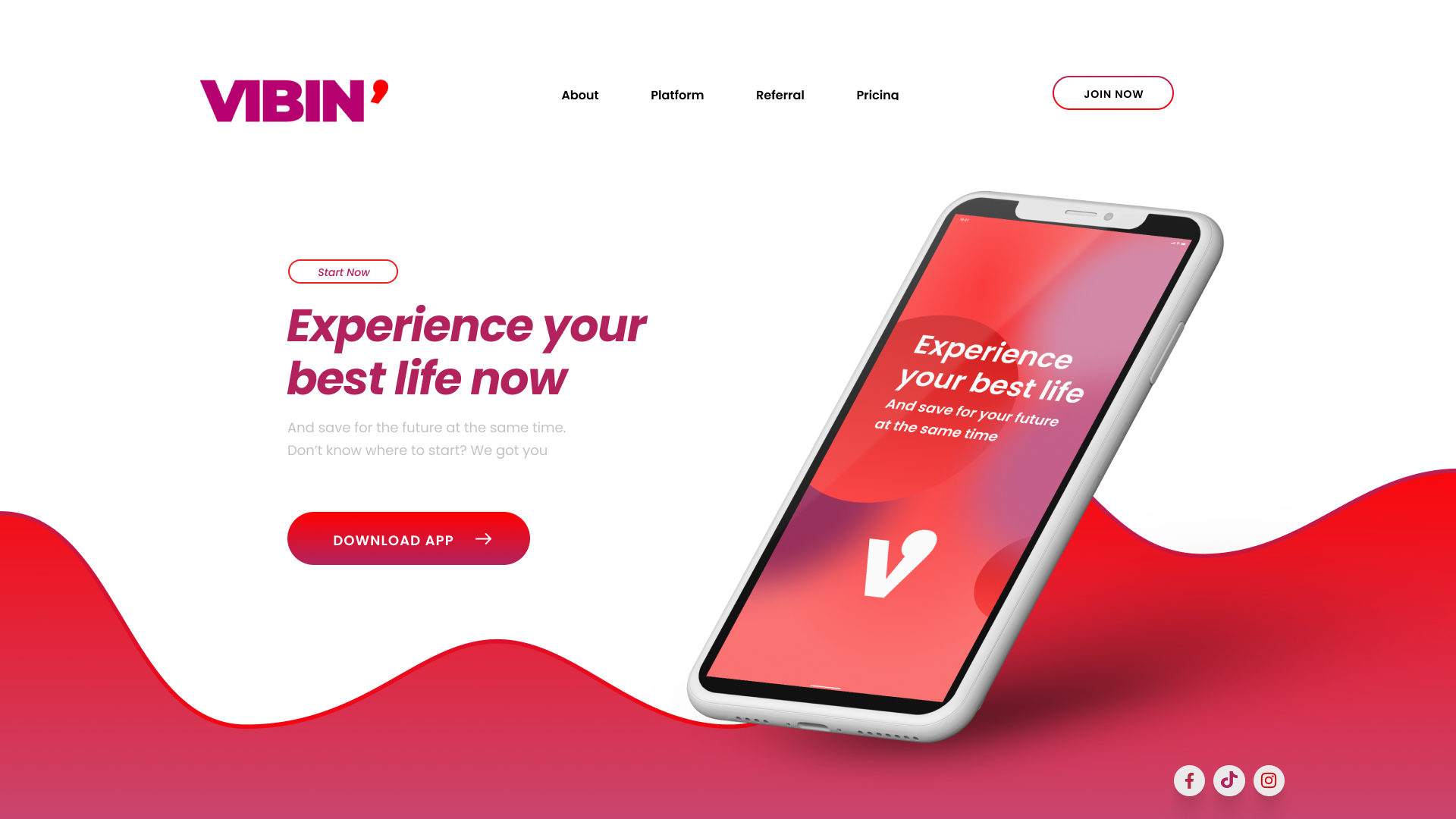

With Vibin’ GenZ can experience their best life, as they are experience hunters and their main goal is to enjoy as many experiences as they can. And save for their future at the same time, because they are aware that in order to be able to live those experiences or to be able to fully reflect their values, they need long-term resources, but they don’t know how to get them yet and that’s where Vibin’ comes in to help.

Clients

Santander & IBM

Release Date

Dec 2021

Role

Project Manager

The Process

- Discover: Research & Exploration

- Define: Synthesis, Problem/Opportunity definition

- Develop: Ideation, Prototyping & Testing

- Deliver: Implementation, Refine Final Solution

Discover & Define

Our team started by triangulating different research methods to gain a deeper understanding of the challenges and opportunities we could address.

We started by doing secondary research on industry insights on unbanked/underbanked population, followed by observations on Banco Santander’s payment methods and processes, interviews with industry experts and active customers of the bank and immersive experiences in which we looked at the crypto market for analogous settings – extrapolated information about the market, behaviour, trends etc.

We also analysed industry trends to search for gaps and opportunities in Santander’s ecosystem.

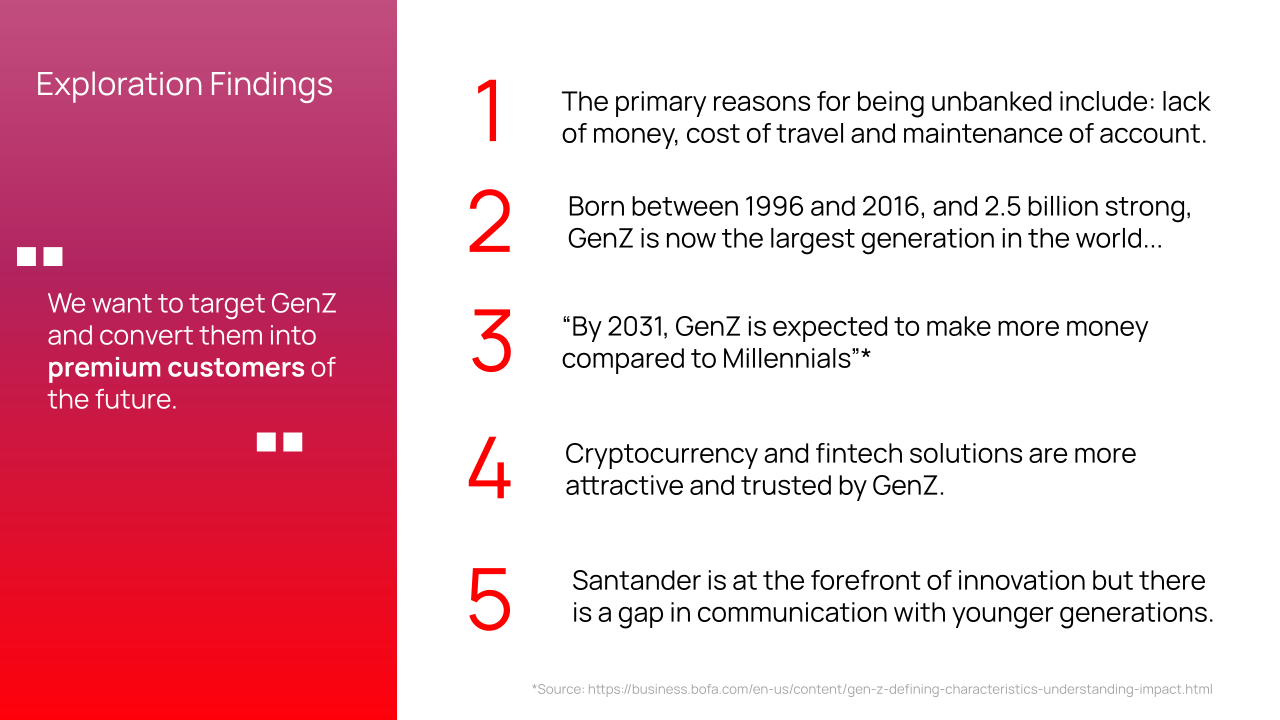

What we found was that:

That’s why we wanted to target GenZ and convert them into the premium customers of the future for Banco Santander.

In order to visualise our target audience better we used different tools such as:

- Personas

- Empathy Maps

- Stakeholder Maps

- Service Blueprints

- Customer Journey Maps

- Opportunity Maps

Those tools helped us empathise with our audience and identify their pain points & opportunities, always keeping GenZ in the centre.

In order to create a solution that meets the needs of Generation Z our team created 2 different personas. Both belong to generation Z and are completely dependent on their parents’ money. But how do they differ?

Sebas is 17 years old, is in high school and lives with his parents. He will most likely stay there for at least 7 more years. He wants to save money for his projects, such as building an engine, and to participate in the social causes he cares about.

The problem she faces is that she has no real control over her allowance and no real knowledge of how much money she receives in order to be able to save a certain amount.

Lucía is 21 years old, lives alone with two flatmates in Madrid. It is the first time in her life that she is managing money and monthly budgets. She is also experiencing an intense fear of missing out (FOMO) because of everything she sees on the social networks of her friends and peers.

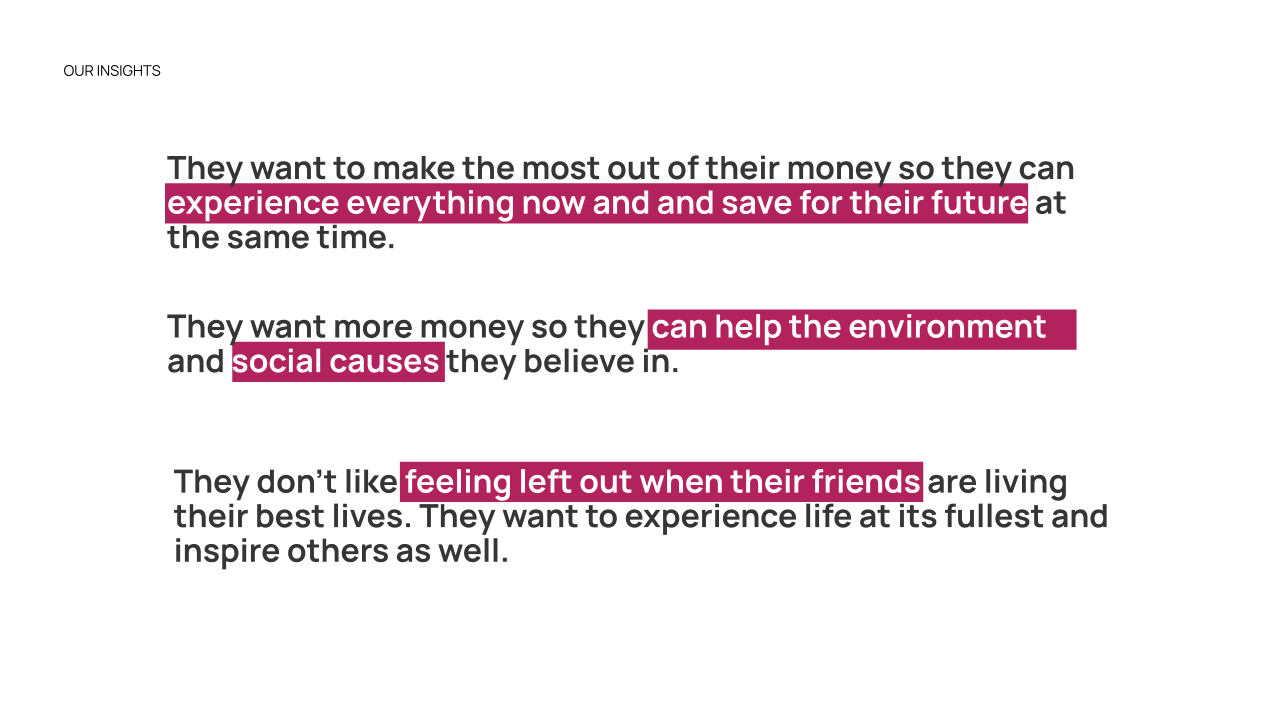

What did we learned from them? These were our key discoveries:

Why did we decide to focus on Gen Z?

In 2020, a report by Bank of America illustrated that Gen Z’s economic power is the fastest-growing around the world: by 2031, they will spend more money than millennials. The entire world should be prepared to a proper “tectonic” shift in consumer behaviour and preferences.

That is why we focused on understanding and knowing what is relevant to this generation and we found that:

- First of all, they want to participate in the market, because they are aware of their power and don’t want to be treated like pawns.

- Moreover, they care that companies the are dealing with would share the same values, as a matter of fact they give importance to ethics, transparency and having a clear identity. They have a lot of possible choices so they want to trust brands which looks authentic.

- Lastly, they reckon the future of the planet depends on them and sustainability has become a crucial theme for their destiny.

We also looked at how Generation Z feels about their current relationships with financial institutions and Gen Z is scared of traditional banks, they don’t trust them, because they often speak in financial jargon that they don’t understand. Some needs are not listened to, because a traditional and consolidated approach is not what they are looking for. Traditional banks like Santander need to innovate to remain relevant to Generation Z and competitive in the future.

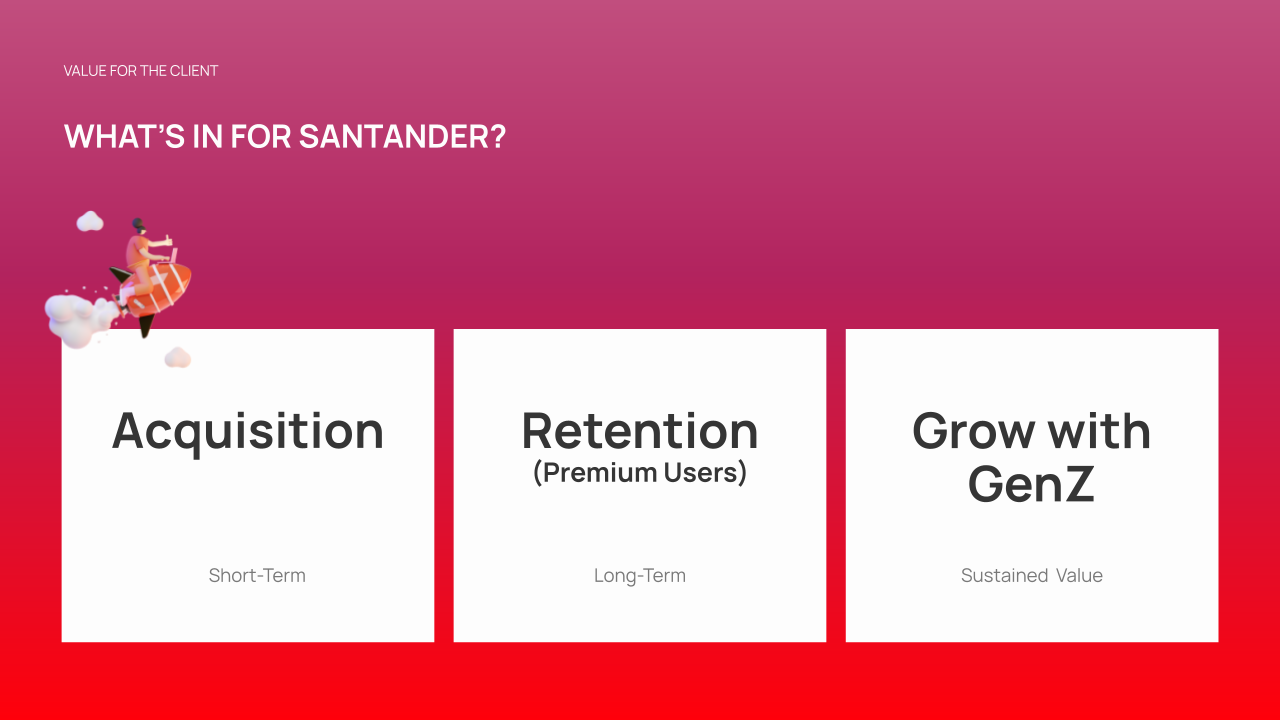

Knowing how GenZ feels, our team focused on creating real, personalised connections with them to achieve valuable acquisitions and retentions for Banco Santander.

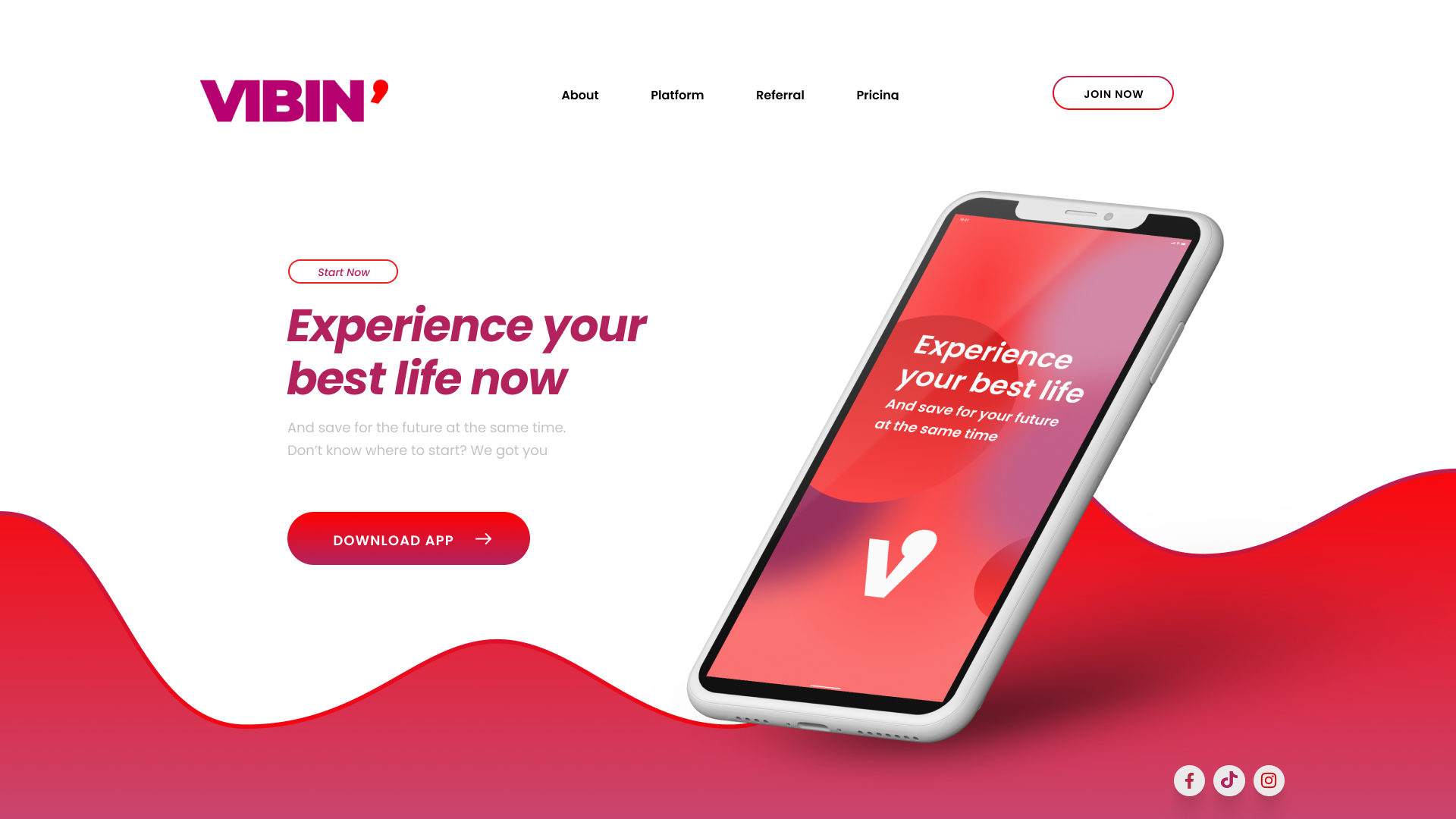

To create this connection with Zoomers, we created Vibin’! The new front end tailor-made for GenZs, powered by Santander.

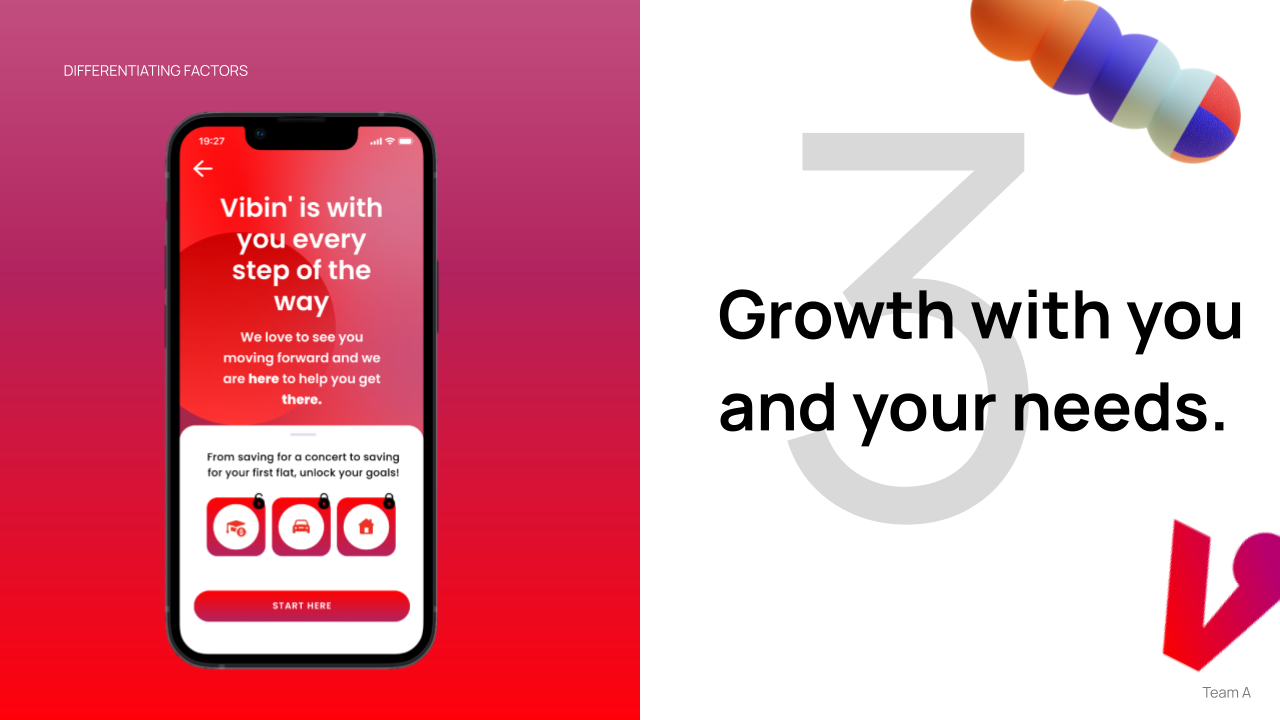

With Vibin’ GenZ will experience their best life, as they are experience hunters and their main goal is to enjoy as many experiences as they can, and save for their future at the same time, as they are aware that to be able to live those experiences or to be able to fully reflect their values they need long term means but they don’t know how to get them yet and that’s where Vibin’ will come in to help.

This new front end will feature a new brand website that will contain all the information GenZ needs.

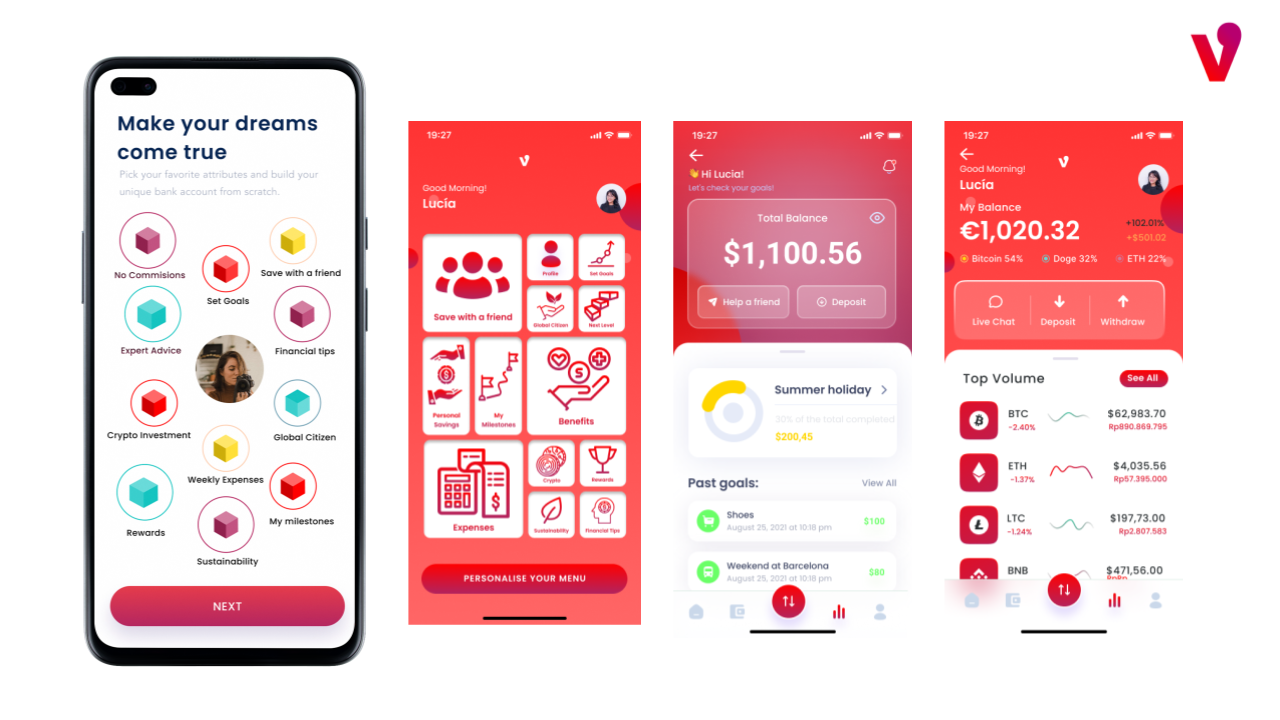

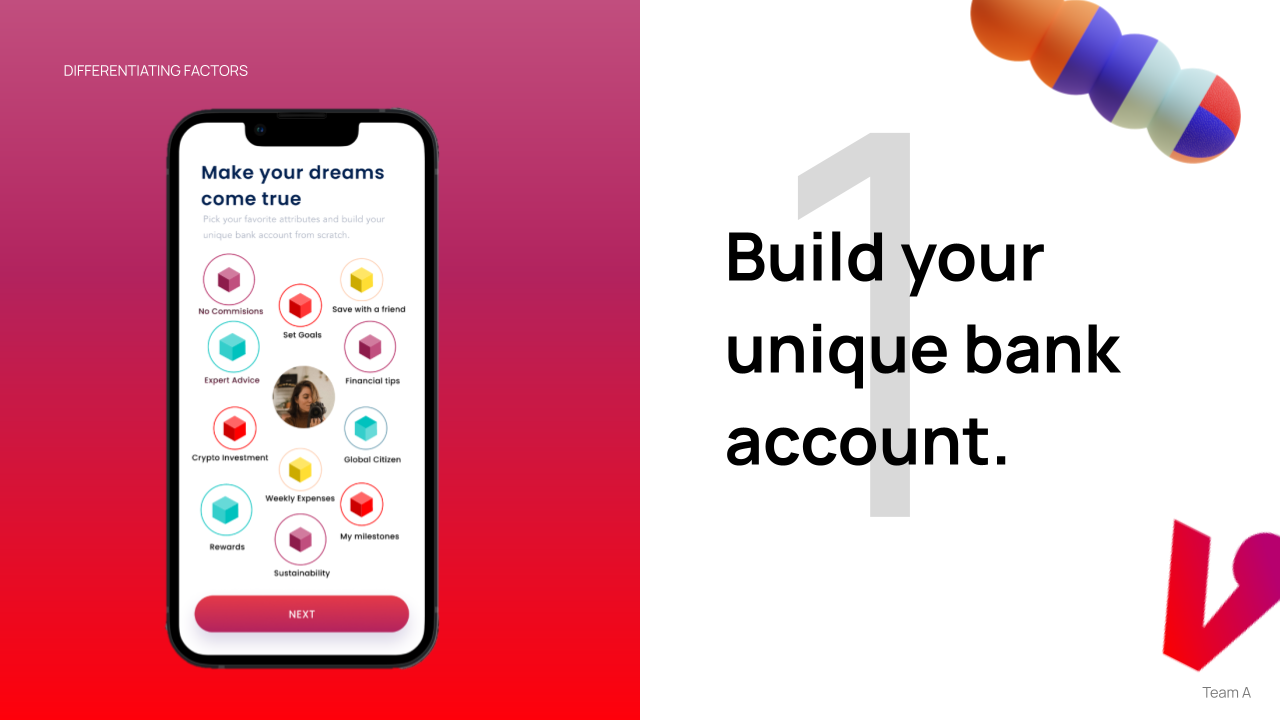

And an app, where you will find tailor-made functions and services. Like personalising their account and app, setting their own goals and milestones and a cryptocurrency service.

Why is it necessary to create a new front-end?

- With Vibin’ zoomeers will see their values reflected on a service that truly gets them, it’s not just a new front end for Santander, it is a whole new experience for genZ.

- Zoomers don’t have trust issues with banks, but they trust more and like better fintechs and other organizations, so by creating a new front end that offers something as valuable for them as uniqueness, will make them more likely to be part of Santander’s customers.

- GenZ is expected to have better incomes than millennials, so Santander needs to acquire and make them premium users starting from now.

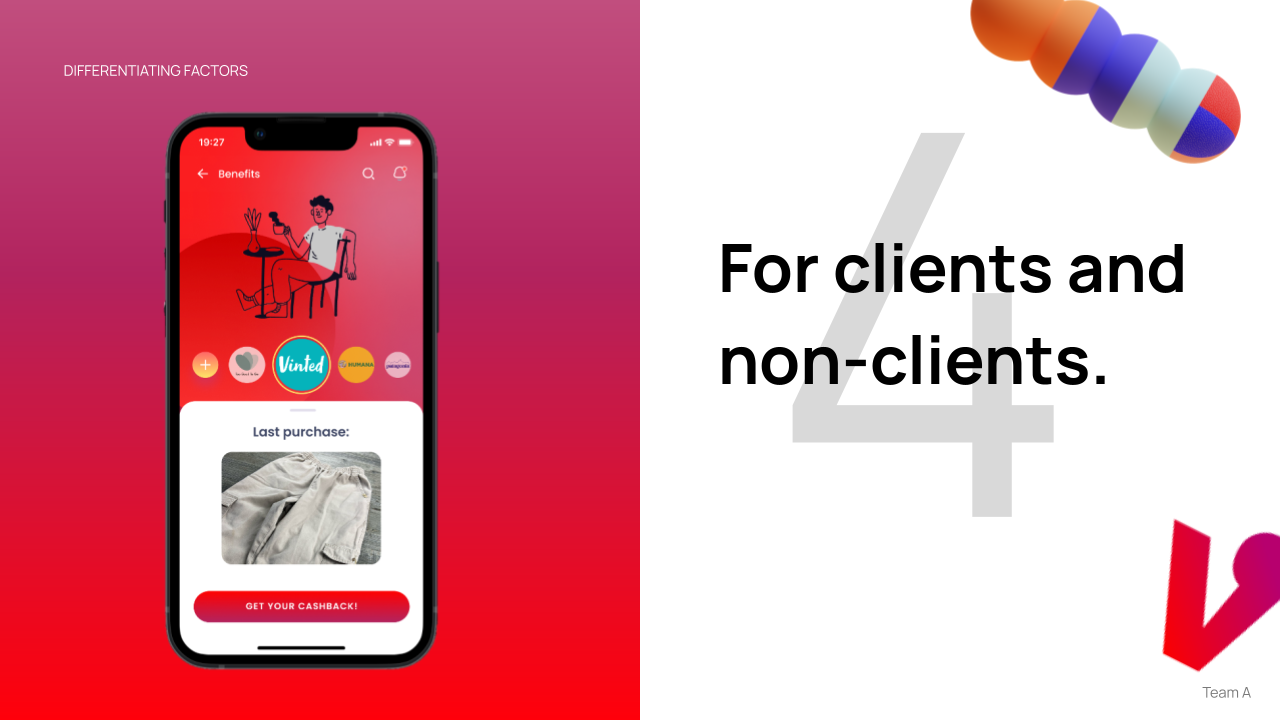

The features that differentiate Vibin' from others

The benefits and value that Vibin’ brings to generation z are reflected in the image below.

In addition, we realised that parents are a very important stakeholder when it comes to GenZ making the decision on where they want to start their financial life, so we also designed and highlighted the benefits they have with Vibin’.

More importantly, this solution creates value for Banco Santander and responded to the challenge we set together with IBM to make the bank relevant to the younger underbanked and unbanked generations.